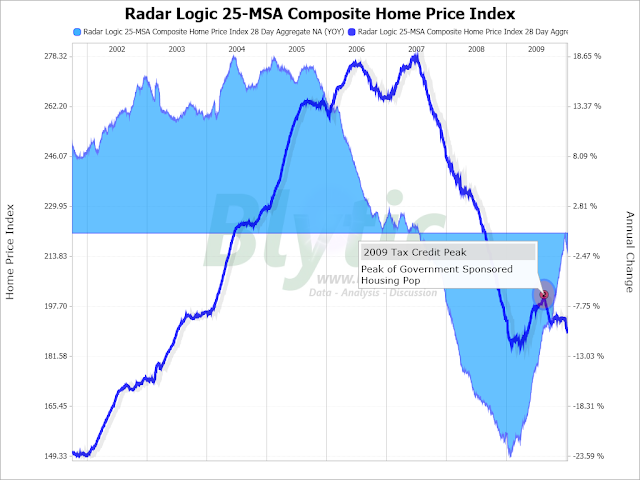

We have come to the point at which a majority of the nation’s housing markets are sitting at, just above or well below the pricing levels seen during March of 2009.

In fact, several markets have even recently broken down below the pricing level seen in the year 2000

Combined, all of this weakness has worked to put downward pressure on the 25 market composite index, thwarting any chances for annual appreciation and bringing ever nearer the specter of a new post-panic low for prices.

Although the government-sponsored bounce worked breathe life into residential real estate, a feat that will be likely repeated as we draw closer to the second tax credit expiration, the effects were essentially temporary.